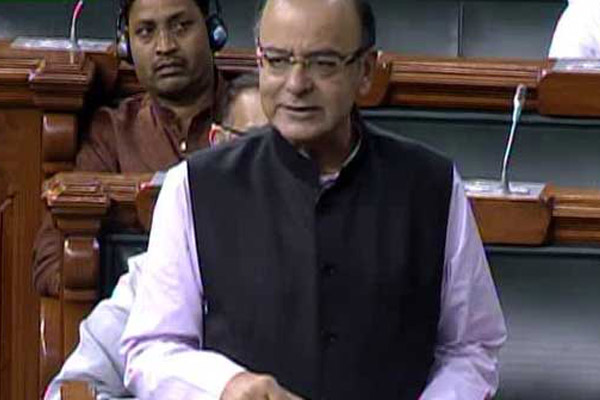

Union Finance Minister Arun Jaitley on Wednesday said the pan-India Goods and Services Tax (GST) regime was an example of federalism at its best, and will go a long way in boosting the revenues of both the Centre and the state governments.

Initiating the debate in the Rajya Sabha on the GST Bill — technically the Constitutional (One Hundred and Twenty-Second Amendment) Bill, 2014 — Jaitley said the efforts of all stakeholders led to a consensus and apprehensions of most states put to rest on the issue.

“The dual dialogue of the empowered committee and political parties has resulted in a large consensus, which is absolutely necessary for a bill of this kind. We have systematically worked towards a larger political consensus,” the minister said.

“This is one of the most significant tax reforms in India’s history. It was, therefore, important for building a political consensus to the extent possible,” he said, adding that the main worry of the states was dilution of their exclusive right to impose tax on goods.

“Some manufacturing states felt the consuming states will benefit more and wanted adequate compensation. Many states felt the petroleum products and alcohol must be kept out of the GST,” he said, adding that a consensus was accordingly arrived at.

While potable alcohol will be outside the GST purview, petroleum products will be zero-rated for the moment — they will attract nil levy under this common tax. But the states can impose their own levies.

Jaitley said this will be the position till a decision is reached on the issue.

The minister also sought to allay another fear among the states — that despite India’s federal structure, the Centre would try to impose its authority, especially when it comes to disputes.

“The Centre will have veto on the states; states will have veto on the Centre,” said Jaitley.

“We have all agreed that the disputes will be resolved by the council,” he said, referring to the empowered committee of state finance ministers getting converted into a GST Council.

Recounting the GST merits, he said the new regime will ensure a check on tax evasion and therefore boost revenues. “Many economists believe it could also give a boost to the country’s growth rate,” he said.

“The enactment of the GST Bill will bring abut the best economic management of the country as it will empower the states and increase revenue of states and the central government. It will give a boost to the economy at this critical stage,” he added.

The GST Bill, termed as the most radical tax reform since Independence, seeks to subsume all central indirect taxes like excise duty, countervailing duty and service tax, as also state levies like Value Added Tax, entry tax and luxury tax, to create a single, pan-India market.